Entities involved

- Account aggregator (AA)

- Financial Information Provider (FIP)

- Financial Information User (FIU)

How they work?

- Consent Request: The Account Aggregator APIs first request user consent to access their financial data from Financial Information Providers (FIPs).

- User Consent: For an FIU to access data from an FIP, the end-user must provide consent. Users authenticate their accounts and authorise the API to retrieve their information.

- Data Collection: Once consent is granted, the APIs connect directly to FIPs to collect financial data, such as account balances and transaction histories.

- Data Aggregation: The APIs consolidate data from various FIPs into a unified format, making it easier to manage and analyse.

- Secure Transfer: The Account Aggregator APIs ensure the secure transmission of data between FIPs and Financial Information Users (FIUs), using encryption and other security measures to protect sensitive information.

- Service Integration: Financial Information Users (FIUs) receive the aggregated data through the API. They leverage this data to provide enhanced financial services, such as budgeting tools, investment analysis, and credit scoring.

Account Aggregator APIs

With Cashfree Payments, you can securely access and aggregate financial data from various accounts and institutions. Utilise our APIs to collect data such as bank account balances, transaction history, investment portfolios, and more, from multiple sources in one place. They simplify the process of connecting to financial institutions by providing a standardised way to retrieve data, making it easier for developers to build applications that involve financial information.| API | Description |

|---|---|

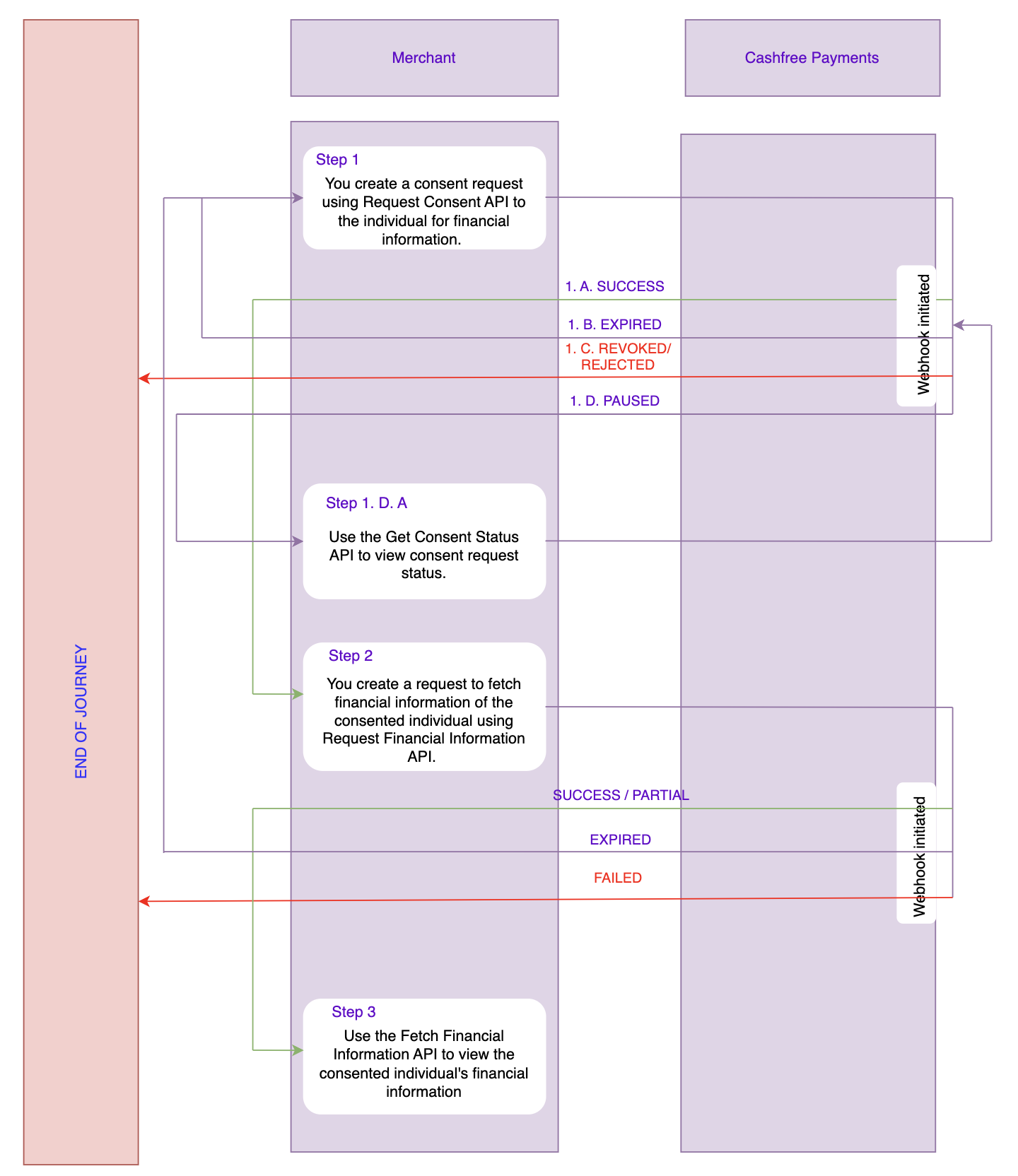

| Request Consent | Use this API to request consent from the individual to fetch the financial information. |

| Get Consent Status | Use this API to get the status of the consent request. |

| Request Financial Information | Use this API to request the financial information of the consented individual. |

| Fetch Financial Information | Use this API to fetch the financial information of the consented individual. |

Use case scenario

A financial advisory firm, X, offers a digital platform that provides personalised financial planning and investment advice. To deliver accurate and tailored advice to clients, X leverages Cashfree Payments’ Account Aggregator APIs to access and aggregate financial data.Steps involved

- Client onboarding

- Consent request

- Data collection

- Data Aggregation

- Financial Analysis

- Personalised Recommendations

- Client Review and Feedback